-

B2B Technology | Fintech | Financial Services | Digital Payments and Identity

-

Marketing Strategy

Growth Leadership

Demand Generation

Project Management and Cross-Functional Delivery

Brand Messaging and Content Direction

Data, Analytics and Funnel Optimization

Key Takeaway: A strong growth marketing program requires clarity of the narrative, rigorous measurement, and a well-orchestrated channel strategy. By shifting to a solutions-based story, activating a multi-touch framework, and implementing tight performance tracking, I increased awareness and accelerated pipeline influence within the FI ecosystem.

Executive Summary

In 2020, I led the growth and demand generation for a leading B2B fintech in the payments and identity verification space. My role was to build the campaign activation architecture, lead cross-functional execution, develop messaging frameworks across three solution areas, partner with product and sales leadership, manage paid media vendors and content agencies, and own multi-touch programs end-to-end.

This program became a repeatable blueprint for future campaigns, and I am proud to say that it still remains one of the most impactful demand generation engines I’ve built.

Challenge

Shift from product-focused promotion to a solutions-based narrative that resonated with FI executives navigating fraud, identity, and faster payments challenges. We also needed to increase our influence on pipeline and accelerate our visibility as a thought leader in the North American banking segment.

Solution

Build a multi-touch demand engine spanning webinars, content syndication, paid media, email, and analyst partnerships. My strategy focused on creating an integrated, data-driven demand engine that spanned paid, owned, earned, and analyst channels.

Results:

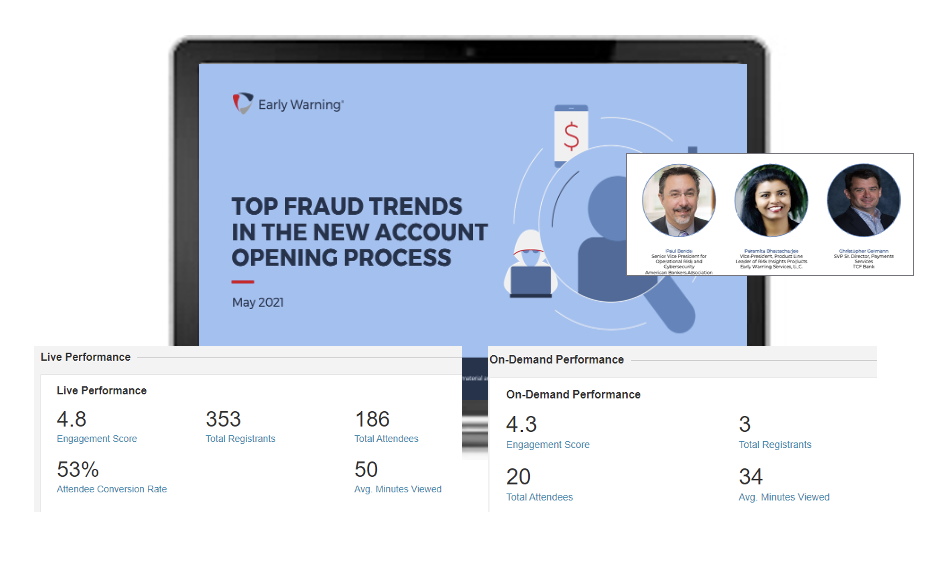

Webinars consistently outperformed benchmarks, including 455 registrants (3× target) and 400+ registrants (+23% above goal) with strong attendance from top 100 U.S. banks.

Syndication and media—WSJ, American Banker, Nacha, Banking Dive, PYMNTS—drove reach, leads, and engagement, with WSJ delivering 72% of all campaign sessions.

Email and LinkedIn activation delivered a 13% CTR, far above industry norms, fueling registrations and content engagement.

Overall, the program materially influenced pipeline, contributing $44.6M ACV and strong MQL performance.

Strategy and Planning

Key elements included:

Developing the campaign framework and brand B2B brand, positioning the company as an innovator enabling safer, seamless FI experiences.

Building a three-tier solutions framework that aligned fraud mitigation, account opening, and real-time payments to customer outcomes rather than product features.

Designing a multi-touch demand architecture incorporating webinars, syndicated content, email nurture, paid media, analyst relations, thought leadership, and a centralized content hub.

Implementing rigorous measurement, including UTM discipline, benchmarking, and funnel performance tracking from prospect to MQL to opportunity to closed-won.